Adopted Budget Book FY 23-24 Final with TOC links - Flipbook - Page 81

Strategic → long Term DebT

City’s Debt to Income Ratio and Borrowing Capacity

The debt-to-income (DTI) ratio is a financial metric that compares the amount of debt that the City

has to its overall income. It provides an indication of the city’s financial health and its ability to

manage and repay its debt obligations based on its income sources.

A higher DTI ratio for a city indicates a larger amount of debt relative to its income, which can

be a sign of financial strain and potential challenges in meeting debt repayment requirements.

Conversely, a lower DTI ratio suggests a healthier financial position with a more manageable level

of debt compared to its income.

The city’s DTI ratio is an important consideration for lenders, investors, and credit rating agencies when evaluating the city’s creditworthiness and financial stability. It helps assess the city’s

borrowing capacity and its ability to take on additional debt for capital projects or infrastructure

improvements.

Maintaining a balanced DTI ratio is crucial for a city’s long-term financial sustainability. It ensures

that the city can meet its debt obligations while continuing to provide essential services and invest

in its growth and development. Monitoring and managing the city’s DTI ratio is essential for prudent

financial planning and responsible fiscal management.

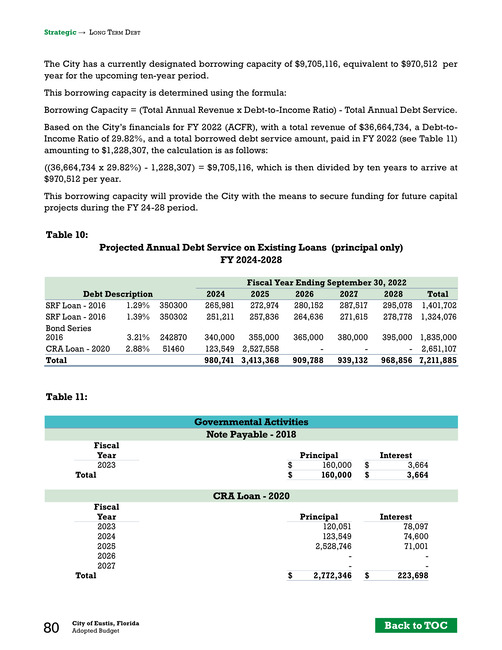

See Table 11 for the financial data, as of September 30, 2022.

DTI = (Total Overall Debt Service / Total Annual Revenue FY) *100

(10,933,960 / 36,664,734) *100 = 29.82%

The City’s present Debt-to-Income (DTI) ratio stands at 29.82%, and is in the recommended

borrowing range of 28-36%, which is considered healthy and financially sound.

The city borrowing capacity refers to the maximum amount of funds that a city can borrow to finance

various projects, initiatives, or infrastructure improvements. It represents the available financial

resources that the city can utilize to invest in its development and meet its financial obligations.

The borrowing capacity of a city is determined by several factors, including its financial stability,

revenue sources, existing debt obligations, creditworthiness, and legal constraints. It is typically evaluated based on various financial ratios and guidelines set by regulatory bodies or financial institutions.

A higher borrowing capacity indicates that the city has the ability to access more funds for capital investments or public projects. This enables the city to undertake essential infrastructure improvements, fund

public services, stimulate economic growth, or address urgent community needs.

Proper financial planning, debt management strategies, and monitoring of the city’s financial health are

crucial to maintaining a healthy borrowing capacity and ensuring the city’s long-term financial wellbeing. The recommended range for borrowing capacity typically falls between 30% and 40%, of the

total assets, providing a guideline for responsible financial decision-making .

In FY 2023, the City fully repaid a loan of $800,000 that was taken out in 2018 for the purchase of a

Pierce Fire Truck. The loan reached its maturity, and the City successfully fulfilled its financial obligation by making the final payment. This repayment indicates the City’s commitment to managing

its debts and maintaining its financial responsibilities. By paying off the loan, the City reduces its

long-term liabilities, increasing the borrowing capacity, and frees up resources for other financial

needs or future investments..

Back to TOC

City of Eustis, Florida

Adopted Budget

79