ACFR FY 2023 Final - Flipbook - Page 96

City of Eustis, Florida

FINANCIAL SECTION

NOTES TO FINANCIAL STATEMENTS

Note 7 - Pension Plans (Continued)

ï

ï

Discount Rate - The discount rate used to measure the total pension liability was 6ÿ70%ÿ The

Pension Plan9s oduciary net position was projected to be available to make all projected future

beneot payments of currently active and inactive employees. Therefore, the discount rate for

calculating the total pension liability is equal to the long-term expected rate of returnÿ

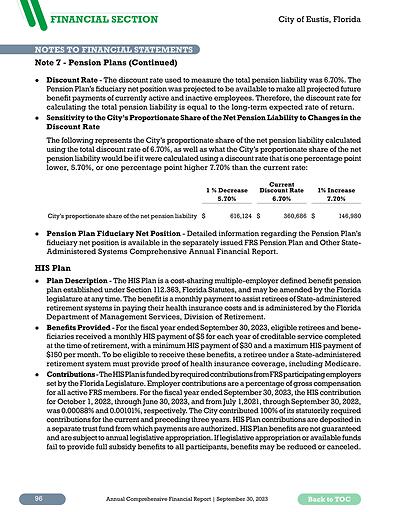

Sensitivity to the City9s Proportionate Share of the Net Pension Liability to Changes in the

Discount Rate

The following represents the City9s proportionate share of the net pension liability calculated

using the total discount rate of 6ÿ70%, as well as what the City9s proportionate share of the net

pension liability would be if it were calculated using a discount rate that is one percentage point

lower, 5ÿ70%, or one percentage point higher 7ÿ70% than the current rate:

1 % Decrease

5.70%

City9s proportionate share of the net pension liability $

ï

Current

Discount Rate

6.70%

616,124 $

1% Increase

7.70%

360,686 $

146,980

Pension Plan Fiduciary Net Position - Detailed information regarding the pension plan9s

oduciary net position is available in the separately issued FRS Pension Plan and Other StateAdministered Systems Comprehensive Annual Financial Reportÿ

HIS Plan

ï

ï

ï

96

Plan Description - The HIS Plan is a cost-sharing multiple-employer deoned beneot pension

plan established under Section 112ÿ363, Florida Statutes, and may be amended by the Florida

legislature at any time. The beneot is a monthly payment to assist retirees of State-administered

retirement systems in paying their health insurance costs and is administered by the Florida

Department of management Services, Division of Retirementÿ

Beneots Provided - For the oscal year ended September 30, 2023, eligible retirees and beneociaries received a monthly HIS payment of $5 for each year of creditable service completed

at the time of retirement, with a minimum HIS payment of $30 and a maximum HIS payment of

$150 per month. To be eligible to receive these beneots, a retiree under a State-administered

retirement system must provide proof of health insurance coverage, including medicareÿ

Contributions - The HIS plan is funded by required contributions from FRS participating employers

set by the Florida Legislatureÿ Employer contributions are a percentage of gross compensation

for all active FRS members. For the oscal year ended September 30, 2023, the HIS contribution

for October 1, 2022, through June 30, 2023, and from July 1,2021, through September 30, 2022,

was 0ÿ00088% and 0ÿ00101%, respectivelyÿ The City contributed 100% of its statutorily required

contributions for the current and preceding three yearsÿ HIS plan contributions are deposited in

a separate trust fund from which payments are authorized. HIS Plan beneots are not guaranteed

and are subject to annual legislative appropriationÿ If legislative appropriation or available funds

fail to provide full subsidy beneots to all participants, beneots may be reduced or canceled.

Annual Comprehensive Financial Report | September 30, 2023

Back to TOC