HRABP - Draft 8 - Flipbook - Page 29

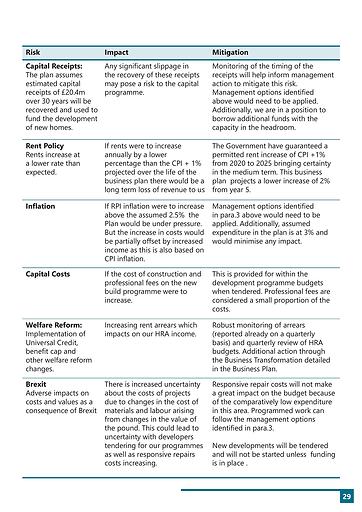

Risk

Impact

Mitigation

Capital Receipts:

The plan assumes

estimated capital

receipts of £20.4m

over 30 years will be

recovered and used to

fund the development

of new homes.

Any significant slippage in

the recovery of these receipts

may pose a risk to the capital

programme.

Monitoring of the timing of the

receipts will help inform management

action to mitigate this risk.

Management options identified

above would need to be applied.

Additionally, we are in a position to

borrow additional funds with the

capacity in the headroom.

Rent Policy

Rents increase at

a lower rate than

expected.

If rents were to increase

annually by a lower

percentage than the CPI + 1%

projected over the life of the

business plan there would be a

long term loss of revenue to us

The Government have guaranteed a

permitted rent increase of CPI +1%

from 2020 to 2025 bringing certainty

in the medium term. This business

plan projects a lower increase of 2%

from year 5.

Inflation

If RPI inflation were to increase

above the assumed 2.5% the

Plan would be under pressure.

But the increase in costs would

be partially offset by increased

income as this is also based on

CPI inflation.

Management options identified

in para.3 above would need to be

applied. Additionally, assumed

expenditure in the plan is at 3% and

would minimise any impact.

Capital Costs

If the cost of construction and

professional fees on the new

build programme were to

increase.

This is provided for within the

development programme budgets

when tendered. Professional fees are

considered a small proportion of the

costs.

Welfare Reform:

Implementation of

Universal Credit,

benefit cap and

other welfare reform

changes.

Increasing rent arrears which

impacts on our HRA income.

Robust monitoring of arrears

(reported already on a quarterly

basis) and quarterly review of HRA

budgets. Additional action through

the Business Transformation detailed

in the Business Plan.

Brexit

Adverse impacts on

costs and values as a

consequence of Brexit

There is increased uncertainty

about the costs of projects

due to changes in the cost of

materials and labour arising

from changes in the value of

the pound. This could lead to

uncertainty with developers

tendering for our programmes

as well as responsive repairs

costs increasing.

Responsive repair costs will not make

a great impact on the budget because

of the comparatively low expenditure

in this area. Programmed work can

follow the management options

identified in para.3.

New developments will be tendered

and will not be started unless funding

is in place .

29